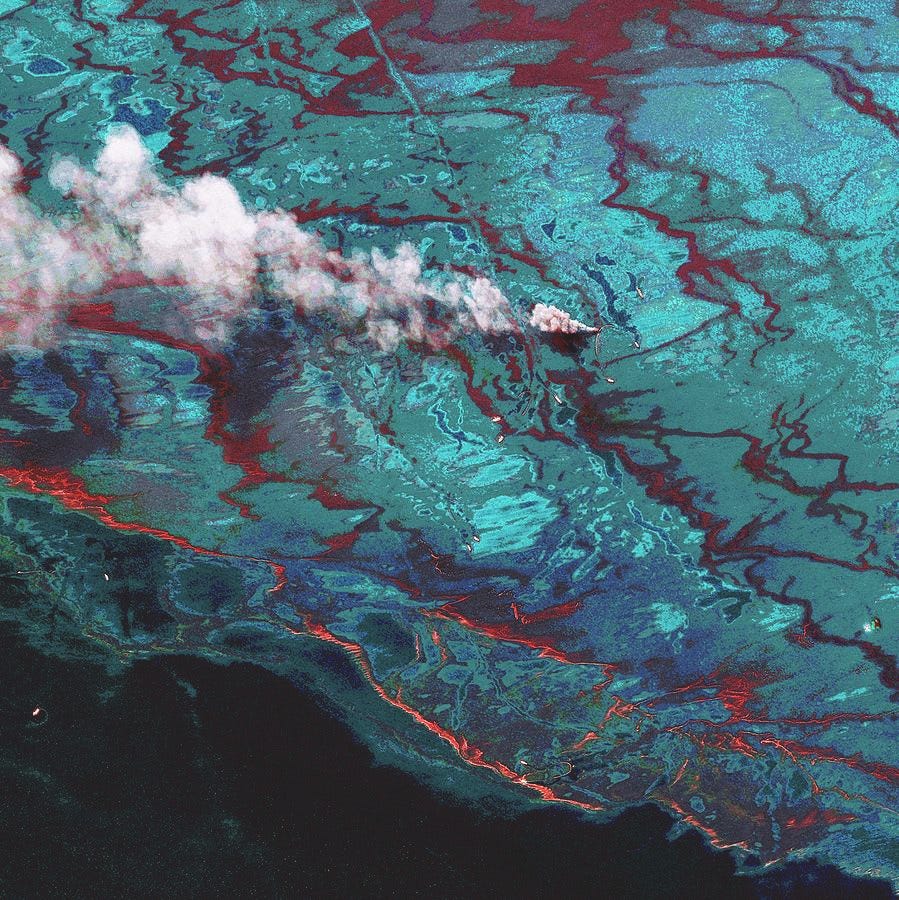

On 20th April 2010, the Deepwater Horizon, a British Petroleum oil rig in the Gulf of Mexico, exploded, killing eleven workers and unleashing an oil leak of volcanic proportions five thousand feet below the surface. By the time the well was finally capped, fully four months later, after many failed attempts, an estimated 4.9 million barrels of oil had billowed into the Gulf. Even capping the well did not seal the leak completely; the pressure split the surrounding rock-bed, and oil continued to seep out in other places.

The bore-hole, at more than thirteen thousand feet, was one of the deepest ever drilled into the earth’s crust, penetrating a huge deposit of heavy crude oil: the Macondo Prospect. At this depth, the astronomical pressures involved created an unprecedented challenge. As the direct result of a sequence of errors and reckless shortcuts, pressure from the well overcame defenses, forcing methane and other gases up into the rig, which exploded when they reached the engine room. The rig burned ferociously until it tipped over and sank on top of the bore-hole two days later, on 22nd April – which happened to be Earth Day. Over the next eighty-seven days, the gusher discharged an estimated two hundred million gallons of oil under pressures of up to seventy thousand pounds per square inch.

The Deepwater Horizon rig was owned by Transocean, a subsidiary of Halliburton Corporation, and operated by British Petroleum. In the run-up to the blow-out, crucial shortcuts were taken which would leave the three corporations pointing fingers at each other after the catastrophe. There was no built-in acoustic switch; the blow-out preventer failed; the steel casing was improperly attached to the blow-out preventer. Four employees of Halliburton had overseen the cementing of the well just twenty hours before the blow-out, using inappropriately formulated cement. Results of safety tests were misinterpreted; a final test, for which a team had been specially flown out to the rig, was cancelled at the last minute; the installation of the second cement plug was aborted mid-operation on BP’s orders for no apparent reason; instead, the heavy drilling mud was flushed out and replaced by sea water, a move which provoked disbelief among rig workers.

It wasn’t just that mistakes were made – they were rammed through in the teeth of fierce opposition from the drilling floor. The operation had already provided some heart-in-mouth moments, with a dangerous build-up of natural gases and a series of ‘kicks’ when drill-heads hit gas pockets. At the beginning of the project BP had been warned by the US government to proceed with caution, but they did the exact opposite of that at every step, handling the record-breaking project with breathtaking recklessness. So egregious was the flouting of normal procedures that it provoked a near mutiny by Transocean workers, culminating in physical scuffles on the bridge.

After the event, CCTV recordings of events on the bridge during the six hours leading up to the disaster were found to be missing; and the rig’s ‘black box’ instrument recorder was never recovered – the first time that this had happened in any oil rig accident.

While the resulting submarine gusher pumped out one and a half million gallons of toxic heavy crude per day, creating a sixty thousand square mile slick and threatening the entire ecosystem of the Gulf, the measures taken to alleviate the effects only made matters worse – horribly so. BP proceeded to saturate hundreds of miles of ocean and shoreline with a chemical dispersant more toxic than the oil itself, and much more poisonous in combination with it. This dispersant, Corexit, had been developed after the Exxon Valdes disaster in Alaska. Corexit emulsifies oil into tiny droplets and submerges it beneath the surface, rather than destroying it. It is designed in effect to hide the problem, rather than fix it. It also absorbs carbon dioxide from sea water, leading to algae blooms which create anaerobic dead zones, displacing all other life forms from the eco-system. In July, when BP was able to announce that 75% of the oil had ‘evaporated’, it was in fact still there, its toxicity, reach and bio-availability magnified by the chemical.

Corexit is poison. Designed to penetrate lipids in order to break up oil, it is equally effective, it turns out, at penetrating the cells of living organisms. Absorption of petroleum hydrocarbons by fish and shellfish is massively enhanced. The result of the spraying was that a deadly, micronized mixture of oil and Corexit permeated throughout the Gulf, entering the water table in neighboring states and soon showing up in rainfall and the food chain. Life in the sea and the swamplands was devastated, as were fishing and shrimping industries and the general economy of the entire region. In August 2012, Hurricane Isaac careered through the Gulf, stirring the brew. People who could, got out; those who remained were plagued by ill-health – headaches, nausea, and horrible skin lesions.

The use of Corexit continued covertly after the completion of the ‘clean-up’ – for years, according to witnesses. The oil-free appearance of the sea surface and the beaches, however, disguised the reality of a vast plume of oil hanging suspended beneath the surface, and mats of oil settling onto the sea floor and into the New Madrid fault-line.

But wait, there’s more. BP wasn’t done yet.

Enter Cynthia, goddess of the hunt, flesh-eating synthetic bacterium.

Cynthia is an engineered microbe designed to eat oil. In fact, the oil-eating bacterium Pseudomonas putida is the creature which ushered in the whole bio-tech revolution, having been the subject of a watershed court case (Diamond vs Chakrabhati) in the Supreme Court of the United States in 1980, in which Justice Warren E Burger ruled that a living, man-made micro-organism is patentable subject matter as a ‘manufacture’ or ‘composition of matter’ within the meaning of the Patent Act of 1952. The multiplasmid hydrocarbon-consuming Pseudomonas was the first patented organism in the world.

In its incarnation as ‘Cynthia’, designed at the J Craig Venter Institute for Synthetic Genomics corporation, the organism was loosed in the Gulf in 2011. At first Cynthia did her job well, tearing into the oil with a fierce appetite. However, she quickly began to show a taste for the flesh of living creatures. Reports of strange occurrences – five thousand birds falling from the sky in Arkansas, a hundred thousand dead fish coughed up by the sea in Northern Louisiana – starting appearing. One hundred and twenty BP employees who had worked on the clean-up fell sick from mystery illnesses. People who swam in the Gulf or were even caught in rainstorms found themselves covered in itching sores, some of them dying in agony from internal bleeding. Apparently Cynthia reproduces rapidly within the body, and is immune to antibiotics. According to the University of the District of Columbia (UDC), up to 40% of the residents of the territories adjacent to the Gulf of Mexico have become infected with severe respiratory and skin diseases.

Soon seals, turtles and dolphins, their bodies covered in skin lesions, were being found as far north as Alaska. One year after the accident, the Department of Oceanography and Coastal Sciences at Louisiana State University was finding lesions, damage to internal organs and grotesque deformities in sea life — including millions of shrimp with no eyes and crabs without eyes or claws — possibly linked to oil and dispersants. A study by the University of South Florida found that the spill and its chemical treatment had caused a “massive die-off” of microscopic organisms at the base of the food chain.

Words hardly exist to describe what was done.

But here’s one: ecocide.

So we curse capitalism and deregulation and greed, and bemoan the incompetence of those under the cosh of the balance sheet. We bemoan the damage done to bolster the huge profits of mega-corporations like BP and Halliburton – and despite the massive penalties placed on BP in US courts, the company was still able to pay out $100 million in dividends to its shareholders that year. Greed, incompetence, reckless endangerment of the very ecosystems which sustain us, utter obliviousness to the sacredness of life in all its forms: this is humanity at its worst.

Looking at the sequence of events, we wonder how it could be that every step that was taken – everything leading up to the blow-out, and everything afterwards – only made matters worse: exponentially worse, turning an already dire situation into an extinction level event. In the case of the Corexit bombardment, the damage was infinitely amplified. Oil on the surface is visible and collectable, using the sophisticated boom systems which exist. Oil under the surface, atomized and dispersed, entering the water table and the water column, convecting through the clouds, eating into every living thing like some particularly hideous chemical weapon, means irreversible, continuing, widening damage, disease and death… and not confined to the region. Confined to the planet. The Gulf of Mexico houses the Loop Current which feeds the Gulf Stream. The toxification of the seas is accompanied by more bad news: there is evidence that with the continued presence of submerged plumes of heavy oil and Corexit leaching into the Loop Current, the chemical impact has affected the behaviour of the Gulf Stream, diverting it away from Europe and bringing rapid warming to the Arctic.

No one wants to look into the abyss. But once again, one must resist the appeal to ignorance.

Not that ignorance doesn’t have its appeal. Never more so than right now.

How can a such perfect storm come together like this? Everything conspired to bring about disaster and then to make it worse. Everything. But no one, of course. Because… well,

“Why would BP blow up its own rig?

I don’t know.

Therefore BP didn’t blow up its own rig.”

First we have to say, there’s no question that they did blow up the rig – their own actions, in very specific sequence, in the teeth of dire warnings, led directly to the blow-out. As the BP’s well-site leader reportedly told the angry drill-crew, ‘That’s the way it’s gonna be.’ And that’s the way it was.

Nobody asks out loud whether it really was an accident – that’s the unexamined assumption of all inquiries into the case, media coverage, and public perception. But this assumption becomes impossible to ignore when it is discovered that the CEO of BP, Tony Hayward, divested himself of BP stocks worth £1.4 million two weeks in advance of the event. Halliburton did the same. Goldman Sachs, part owner of Corexit, placed put-options on ‘the whole of the Gulf’, as one commentator phrased it. Transocean, the owner of the rig, placed put-options on its own stocks on the very morning of the disaster. Out of the blue, Halliburton also acquired the world’s leading specialist oil clean-up operation, Boots and Coots, in a move which puzzled observers at the time.

Ten days later, the event occurred which made sense of all these actions.

The insider-trading shows conspiracy, foreknowledge, and intent. In view of the insider-trading, combined with the insanely reckless decisions made by BP and Halliburton, we have to conclude – I see no way round it – that the Deepwater Horizon disaster was deliberately engineered.

The oil, and then the Corexit. It’s almost as if it was designed to magnify the damage. A chemical weapon. Then the flesh-eating bio-weapon, Cynthia, huntress of everything. Poison, corrosion, sepsis.

Could they have made it any worse if they’d tried?

Why? Why would they do that?

Hold that question.

Now, rather than making the appeal to ignorance, I invite you to consider the work of the brilliant but little known satirist, Leonard C Lewin.

“An effective political substitute for war would require ‘alternate enemies,’ some of which might seem equally far-fetched in the context of the current war system. It may be, for instance, that gross pollution of the environment can eventually replace the possibility of mass destruction by nuclear weapons as the principal apparent threat to the survival of the species. Poisoning of the air, and of the principal sources of food and water supply, is already well advanced, and at first glance would seem promising in this respect; it constitutes a threat that can be dealt with only through social organisation and political power. But from present indications it will be a generation to a generation and a half before environmental pollution, however severe, will be sufficiently menacing, on a global scale, to offer a possible basis for a solution.” — The Report from Iron Mountain, On the Desirability and Possibility of Peace, Dial Press, 1967

LINKS

The ‘accident’

http://www.nola.com/news/gulf-oil-spill/index.ssf/2010/05/costly_time-consuming_test_of.html

http://www.wsws.org/en/articles/2010/05/spil-m14.html

Ecocide

Corexit

http://www.huffingtonpost.com/2013/04/25/corexit-bp-oil-dispersant_n_3157080.html

http://www.curezone.org/forums/am.asp?i=2191551

Cynthia

http://www.march-against-monsanto.com/cynthia-flesh-eating-synthetic-bacteria-has-mutated-spreading-uncontrollably/

First published at thelethaltext.me

Great article, I had no idea about the extent of the deep water disaster before, I'd only heard about the oil spill part of it. The climate change scam is a good way to distract people from habitat destruction and pollution, which are far more dangerous and prescient threats to the natural world. I'm very opposed to big government, but environmental regulations are absolutely necessary to prevent everything green on this planet from getting destroyed for profit.

That is DAMN suspicious.

From Grok;

“To verify the details mentioned in the paragraph from the article:

- **Tony Hayward's Stock Sale**:

- According to the web results provided earlier, several sources mention that Tony Hayward sold £1.4 million worth of BP shares before the oil spill. This is reported by multiple sources, including the London Telegraph as cited in the web results. However, exact timing (two weeks before) isn't uniformly confirmed across these sources. What is commonly noted is that it occurred within weeks before the spill.

- **Halliburton's Actions**:

- The acquisition of Boots & Coots by Halliburton is well-documented. Web results state that Halliburton purchased Boots & Coots on April 9, 2010, which was indeed about 11 days before the Deepwater Horizon explosion on April 20, 2010. This timing matches the narrative in the article.

- **Goldman Sachs and Put-Options**:

- The narrative about Goldman Sachs placing put-options on "the whole of the Gulf" is less clear and more speculative in the sources provided. There's mention of Goldman Sachs selling off a significant portion of their BP stock before the spill, but specific details about put-options on the Gulf region are not directly corroborated in the provided results. However, there was a noted sell-off of BP shares by Goldman Sachs, which could align with the intent to profit from a potential stock price drop.

- **Transocean's Put-Options**:

- The claim that Transocean placed put-options on its own stocks on the morning of the disaster isn't explicitly detailed in the web results. However, there's a mention in one source (web:8) about Transocean and a "put option" for preferred insiders, but without specifying the exact timing or directly linking it to the morning of the disaster.

**Verification Summary:**

- **Tony Hayward's sale of BP stock**: Generally confirmed but exact timing might vary.

- **Halliburton's acquisition of Boots & Coots**: Confirmed with the exact date matching the narrative.

- **Goldman Sachs' actions**: Partially confirmed regarding stock sales, but specifics about put-options on "the Gulf" are not verified in the provided results.”

- **Transocean's put-options**: Mentioned in one source but without precise details matching the article's claim.

For a complete verification, especially for the more speculative claims like the exact nature of put-options, further research into financial filings, news reports from the time, or regulatory investigations would be necessary. If you want to delve deeper into these specifics, we might need to perform a web search or look into financial records and media reports from that time.